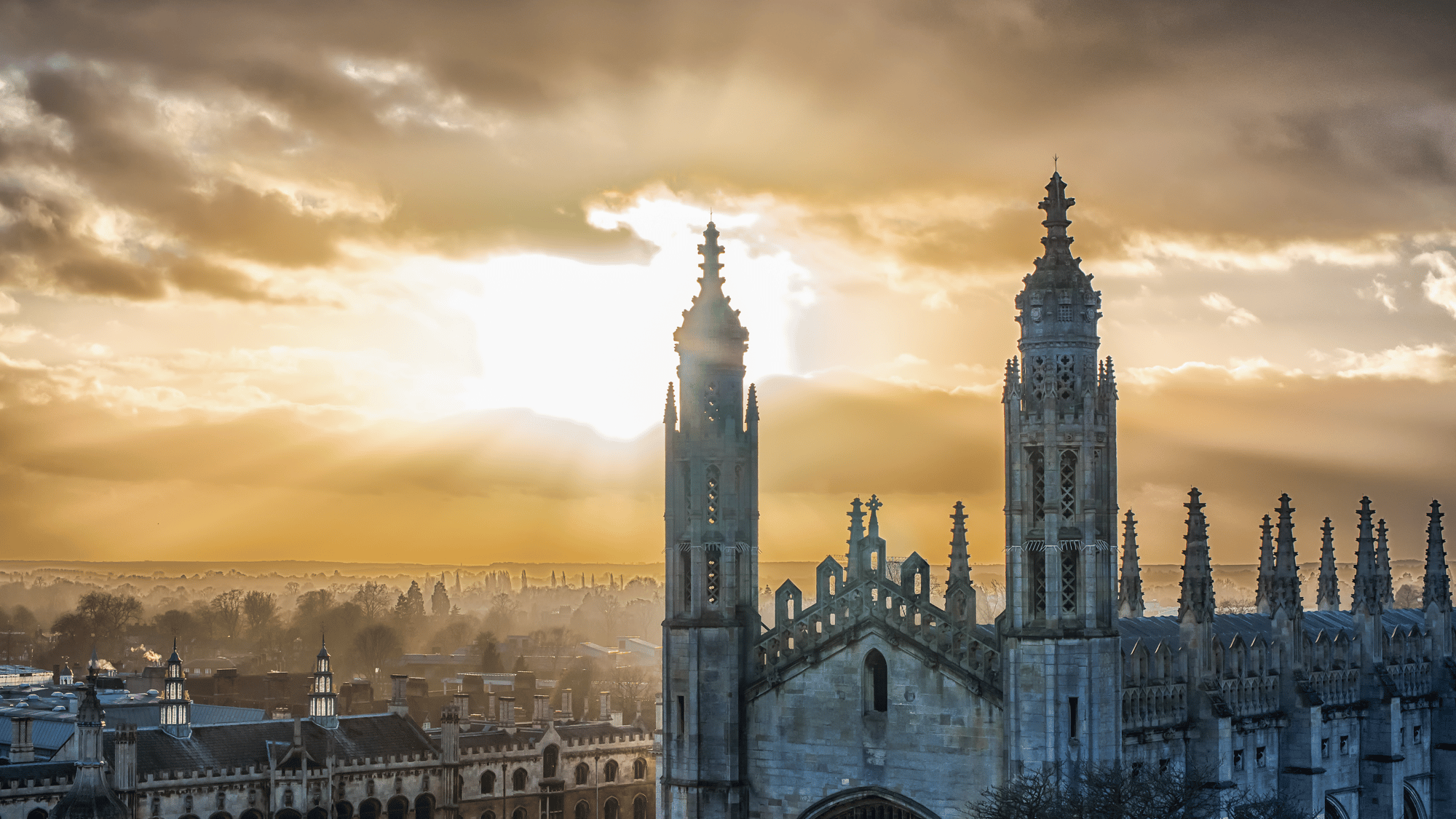

THE DECLARATION TO TRANSFORM CAMBRIDGE INTO EUROPE'S SILICON VALLEY HAS BOLSTERED THE CITY'S REPUTATION AND CONFIDENCE IN IT'S GROWTH POTENTIAL.

Cambridge stands as one of Europe’s foremost locations for research and development, driven by the renowned University of Cambridge, which ranks within the top five in the Times “Higher Education World University Rankings for 2024”. The city’s R&D sector is diverse, encompassing firms in biotechnology, pharmaceuticals, electronics, and software engineering.

.png?width=2000&height=1125&name=Untitled%20design%20(43).png)

- Cambridge Science Park (owned by Trinity College Cambridge)

- Babraham Research Campus (owned by UK Research and Innovation)

- St John’s Innovation Park (owned by St John’s College)

- Cambridge Research Park

- Granta park

life sciences FUNDING

In 2023, life sciences companies headquartered in Cambridge secured $4.7 billion in funding. Excluding AstraZeneca’s post-IPO debt funding, which accounted for a significant portion, the total funding was approximately $960 million, marking the second-highest amount on record. Notably, Apollo Therapeutics raised $225 million in a series C round, CMR Surgical secured $164 million in a series D round, and T-Therapeutics garnered $60 million in a series A round.

.png?width=2000&height=1125&name=Untitled%20design%20(44).png)

demand and leasing activity

Cambridge’s office and laboratory leasing activity remains robust, driven by sustained demand from technology and life science firms. In 2023, over 75% of leased space was occupied by these sectors, from startups to established firms. This high demand has pushed prime lab rents from £41.50 per sq ft in 2018 to £71 per sq ft in 2023, reflecting a 69% growth rate.

laboratory space storage

Despite a promising development pipeline, Cambridge faces a critical shortage of laboratory space. New developments, including One Granta Park and The Press, are underway, but available lab space remains scarce outside Unity Campus and Cambridge Biomedical Campus. Projects totalling approximately 2, 531, 000 sq ft of lab space are in planning, with completion expected by mid-2026. This shortage has led companies to repurpose existing commercial buildings for laboratory use, highlighting the urgent need for dedicated lab spaces.

investor confidence and market DYNAMICS

Investor confidence in Cambridge remains strong despite a dip in office/lab investment to just over £100 million in 2023. The market is characterised by low yields, with prime laboratory yields around 4.75% and office yields at 5.5%, reflecting positive sentiment and resilience despite the shift to hybrid working. Redevelopment plays are popular, evidenced by significant transactions like UBS and Reef’s acquisition of the Westbrook Centre for £75 million and Cadillac Fairview and Stanhope’s purchase of 163 Cambridge Science Park for £12.2 million.

Cambridge continues to be a focal point for R&D and life sciences, with its robust funding environment, high demand for office and lab spaces, and strong investor confidence positioning it as a leading innovation hub in Europe.

READ OUR WORKPLACE GUIDE

HOW MUCH DOES A COMMERCIAL FIT-OUT COST IN 2024?

In 2024, the overall cost of an office fit out will vary depending on a variety of factors including size and scope, materials used, labour costs and finishes. Companies may also encounter unexpected costs related to site access and regulatory requirements. Planning ahead can help manage the costs of a commercial fit out as this will allow for research into suitable materials and suppliers, meaning it is important to do detailed research before making any decisions.

.png)

LET'S TALK ABOUT YOUR NEXT REQUIREMENT